The convergence is undeniable. As Apple enters 2026, the company faces a confluence of pressures, opportunities, and transitions that will fundamentally test whether it can maintain its $4 trillion valuation and market dominance. This isn't hyperbole—the simultaneous arrival of unprecedented leadership turnover, explosive memory costs, aggressive regulatory scrutiny, and the most ambitious product roadmap in years creates a scenario where Apple's strategic decisions will reverberate for the next decade.

For those watching Apple closely, 2026 represents something more significant than another product cycle. It's a stress test of the company's core operating assumptions at a moment when its rivals are moving faster in AI, its costs are spiking due to market forces beyond its control, and its leadership structure is experiencing the most dramatic transformation since Tim Cook succeeded Steve Jobs in 2011.

The Product Gambit: Betting Big Across the Board

Apple's 2026 product roadmap reads like a company trying to make up for lost time. The sheer volume and ambition of what's rumored for release suggests a strategic acceleration that's both impressive and risky.

The iPhone Evolution: Folding Into the Future

The most consequential product launch may be the foldable iPhone, codenamed V68 in leaked iOS 26 builds. After years of watching Samsung, Google, and others iterate on foldable technology, Apple is reportedly preparing a book-style device with a 7.7-inch unfolded display. The timing is calculated—enter after competitors have absorbed the R&D costs and early adopter pain, but not so late that the category has matured without them.

But here's where it gets interesting: Apple is simultaneously launching the iPhone 18 Pro models with under-display Face ID technology, eliminating the Dynamic Island entirely. This represents a significant design risk, betting that the technology is mature enough for mass production while its foldable display production is reportedly experiencing high failure rates. Launching both in fall 2026 means Apple is doubling down on advanced display technologies at precisely the moment when supply chains are stressed and component costs are surging.

The iPhone 17e, arriving early in the year with Apple's C1X modem, serves as both a market test of Apple's custom silicon ambitions and a critical entry point for price-sensitive markets. Its success or failure will signal whether Apple can maintain margins while moving away from Qualcomm dependency.

The Computing Renaissance: Silicon Proliferation

The Mac roadmap for 2026 is almost bewildering in its scope. Apple plans to ship seven distinct Mac configurations: M5 MacBook Air, M5 Pro/Max MacBook Pro, an A18 Pro-powered budget MacBook, M5 Max/Ultra Mac Studio, and late-year M6 MacBook Pro models with OLED displays. This represents Apple's most aggressive Mac update cycle in history.

The strategic calculus here is transparent: Apple is leveraging its silicon advantage before the competition catches up. But the economics are challenging. With DRAM prices exploding—reportedly doubling in contract pricing in recent months—even Apple's legendary supply chain management faces constraints. The company's long-term memory agreements are reportedly expiring in January 2026, exposing Apple to the same cost pressures crushing PC manufacturers like Dell and Lenovo, who've announced 15-20% price increases.

The A18 Pro MacBook is particularly intriguing. It signals Apple testing whether its phone chips can viably power entry-level computing, potentially opening a new low-cost segment while protecting margins through vertical integration. If successful, it fundamentally changes the economics of budget computing.

The Smart Home Pivot: Finally Getting Serious

After years of half-measures in the smart home market, Apple appears ready to commit. The rumored smart home hub with wall-mount and speaker-base options, arriving March-April 2026, represents Apple's attempt to own the home automation category that Amazon and Google have dominated. More intriguingly, the tabletop robot with a robotic arm (codenamed J595) for 2027 suggests Apple sees the home as a critical AI deployment platform.

This timing is strategic—arriving alongside the significantly improved Siri powered by what's reportedly Google's Gemini AI framework. Apple is acknowledging that voice assistants need genuine intelligence to be useful, even if it means partnering with a competitor.

Vision Air and Wearable AI: The Next Computing Platform

The lightweight, more affordable Vision Air expected later in 2026, combined with reports of AI smart glasses potentially unveiled before year-end, reveals Apple's bet on spatial computing as a long-term platform. But the economics are daunting. Vision Pro's high price limited it to early adopters; Vision Air needs to hit a dramatically lower price point while memory costs are spiking. The company is threading a needle between accessibility and profitability.

The Leadership Earthquake: Rebuilding While Flying

The scale of Apple's executive exodus is historically unprecedented for the company. In less than six months, Apple has announced the departures of:

- John Giannandrea (SVP of Machine Learning and AI Strategy)

- Jeff Williams (Chief Operating Officer)

- Kate Adams (General Counsel)

- Lisa Jackson (VP of Environment, Policy, and Social Initiatives)

- Alan Dye (VP of Human Interface Design)

- Luca Maestri (CFO, transitioning roles)

This represents the departure of executives who collectively shaped Apple's operations, legal strategy, design language, environmental initiatives, and AI direction. The conventional narrative is that this is planned succession. The uncomfortable reality is that this much simultaneous transition creates execution risk precisely when Apple needs operational excellence.

The AI Leadership Gamble

The replacement of John Giannandrea with Amar Subramanya from Microsoft is the most consequential change. Giannandrea's cautious, privacy-first approach reportedly frustrated leadership as competitors raced ahead. Subramanya brings experience in large-scale AI model development from Google and Microsoft—companies that moved faster but with different privacy paradigms.

This signals Apple's strategic pivot: maintaining privacy principles while dramatically accelerating AI deployment. But Subramanya is stepping into a role that's been restructured—Siri development now reports to Craig Federighi's software group, not AI leadership. This redistribution of responsibilities could either enable faster execution or create coordination challenges.

The critical question: Can Subramanya accelerate Apple Intelligence development fast enough to close the gap with ChatGPT, Gemini, and Microsoft Copilot while respecting Apple's on-device processing constraints? The spring 2026 Siri relaunch tied to iOS 26.4 is his first major test.

Design Leadership Returns to Roots

Alan Dye's departure to Meta and replacement by Stephen Lemay has reportedly generated internal excitement. Lemay worked on every major Apple interface since the original iPhone, and his appointment signals a potential return to the detail-obsessed design culture that defined early iOS. But he's inheriting a design organization that's been criticized for losing its edge—the iOS interface has stagnated, and visionOS needs dramatic refinement.

The timing is significant: Lemay takes charge as Apple prepares to launch its most design-ambitious products in years (foldable iPhone, OLED MacBook Pro, Vision Air). His success or failure will determine whether Apple recaptures its design leadership.

Legal and Regulatory Consolidation

Jennifer Newstead's appointment from Meta as General Counsel, with expanded responsibilities covering government affairs, represents Apple's acknowledgment that legal and regulatory challenges are now inseparable. Her experience navigating Meta's regulatory battles positions her for the intensifying antitrust scrutiny Apple faces globally.

The consolidation of legal and government affairs under one executive streamlines decision-making but also creates a single point of failure. If regulatory challenges accelerate beyond Apple's ability to adapt—particularly around the App Store's economics—Newstead's ability to manage simultaneous battles in the EU, U.S., India, and other markets becomes critical.

Operational Transition Under Pressure

Sabih Khan's elevation to COO from his role leading operations comes at a moment when supply chain management is more critical than ever. With memory costs exploding and component availability constrained, Khan must manage Apple's legendary supply chain through unprecedented turbulence. His success will be measured not in innovation but in whether Apple can maintain product availability and margins while competitors struggle.

The Cook Question

Tim Cook's potential transition to Executive Chairman in 2026 looms over all these changes. Reports suggest John Ternus, SVP of Hardware Engineering, is the leading CEO candidate. The coordination of these executive transitions alongside a potential CEO change suggests deliberate succession planning—or creates the possibility of a leadership vacuum if the transitions don't synchronize properly.

The Economic Vise: Memory, Margins, and Market Realities

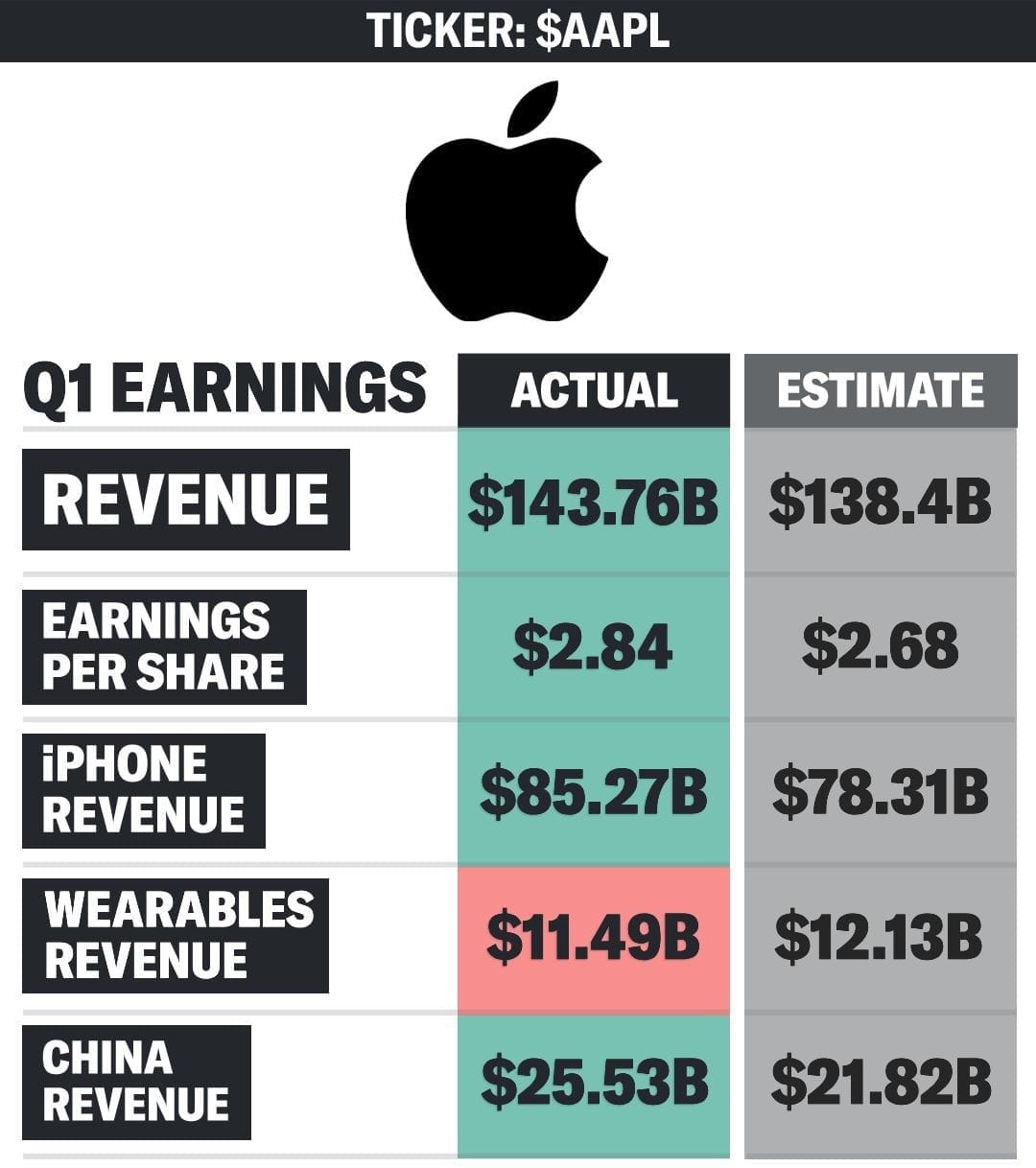

The RAM crisis represents an external shock that even Apple's supply chain mastery struggles to fully mitigate. DRAM and NAND prices have exploded due to capacity reallocation toward high-bandwidth memory (HBM) for AI data centers. The numbers are staggering:

- Contract prices for some DRAM categories increased 80-100% month-over-month in December 2025

- Average PC prices expected to jump 4-8% in 2026

- Memory now represents approximately 18% of a PC's bill of materials, double the 2024 share

- Dell's COO stated he's "never seen memory-chip costs rise this fast"

Apple negotiated long-term memory agreements that expire in January 2026, meaning the company will face spot market pricing precisely as it launches its most memory-intensive product lineup. The iPhone 18 Pro, M5 MacBooks, iPad Air with M4, and base iPad with A19 all require substantial memory allocations—particularly to support Apple Intelligence features requiring minimum 8GB RAM.

The Strategic Implications

This creates several challenges:

Margin Pressure: Even with Apple's scale, memory cost increases will compress margins unless Apple raises prices. TrendForce reports that memory components in iPhones specifically are expected to "significantly increase" in Q1 2026, potentially forcing Apple to reconsider pricing strategies for new models.

Product Differentiation: Apple has traditionally used memory tiers to differentiate products and maximize profit. With base memory costs spiking, the company may need to reduce base configurations (reverting low-end products to 4GB RAM) or accept lower margins to maintain competitiveness.

AI Feature Accessibility: Apple Intelligence requires 8GB minimum RAM. If memory costs force Apple to ship 6GB base configurations in some markets, it creates a product lineup where flagship AI features are unavailable to significant customer segments.

Competitive Dynamics: Unlike PC manufacturers who've announced immediate price increases, Apple's brand positioning makes dramatic price hikes risky. Competitors struggling with memory costs creates an opportunity for Apple to maintain pricing and capture share—if it can absorb costs competitors cannot.

The memory crisis also impacts storage. NAND prices are following similar trajectories, affecting iPad, iPhone, and Mac product configurations. Apple's traditional strategy of high storage markups becomes complicated when base storage costs are volatile.

Supply Allocation Wars

Beyond pricing, allocation itself becomes strategic. Memory manufacturers prioritize large customers, but even Apple must compete for capacity against cloud providers like AWS, Microsoft, and Google who're buying massive quantities of HBM for AI infrastructure. Some reports suggest these hyperscalers have secured multi-year allocations, leaving less capacity for consumer electronics.

This means Apple's 2026 product launches face potential supply constraints even at higher prices. The foldable iPhone's reported high display failure rate combined with memory constraints could limit initial availability, affecting adoption and revenue realization.

The Regulatory Gauntlet: Fighting on Multiple Fronts

Apple enters 2026 defending itself against antitrust actions across multiple jurisdictions, each with different demands and potentially conflicting requirements.

United States: App Store Economics Under Attack

The DOJ lawsuit filed in March 2024, now joined by 21 states, challenges Apple's App Store policies, integration strategies, and ecosystem lock-in. The core allegation is that Apple leverages its platform control to stifle competition and maintain excessive fees.

Unlike previous antitrust cases focused on consumer harm through higher prices, the DOJ's case emphasizes harm to developers and the suppression of competitive alternatives. This makes it particularly challenging—Apple must argue that its 15-30% App Store commissions are reasonable while competitors offer lower rates, and that its ecosystem integration creates value rather than lock-in.

The timing is problematic. As Apple attempts to monetize Apple Intelligence through potential subscription tiers, antitrust scrutiny of its platform economics intensifies. Any move toward required Apple Intelligence subscriptions faces questions about whether Apple is leveraging its platform dominance to force adoption of its services.

European Union: DMA Compliance Theater

The Digital Markets Act forced Apple to allow third-party app stores and alternative payment systems in the EU. Apple's response—implementing these changes while maintaining complex fee structures that still capture significant revenue—has drawn continued criticism.

Apple's Core Technology Fee structure in the EU (charging developers for installations above certain thresholds even if they use alternative app stores) is being challenged as DMA circumvention. The European Commission can impose fines up to 10% of global annual revenue for non-compliance. For a $4 trillion company, potential penalties are measured in tens of billions.

More significantly, the EU is now a testing ground for "open" platform policies that other jurisdictions may adopt. Japan recently implemented similar changes under the Mobile Software Competition Act, forcing Apple to reduce its effective take rate to 5-26% depending on distribution method. This regulatory arbitrage creates a patchwork of different platform economics by region.

India: The Global Revenue Penalty Risk

Apple is challenging an Indian antitrust law allowing the Competition Commission of India to calculate penalties using global turnover rather than local revenue. The stakes are existential—a 10% penalty would equal approximately $38 billion.

The case tests whether countries can impose penalties based on global operations for local violations. If India's approach is upheld and adopted elsewhere, Apple faces dramatically higher regulatory risk in every market. This fundamentally changes the risk-reward calculation for market entry strategies.

China: The Unspoken Elephant

While not technically a regulatory challenge, Apple's dependence on China for manufacturing and as a growth market creates geopolitical risk that functions similarly to regulation. Any deterioration in U.S.-China relations could result in:

- Supply chain disruptions affecting product availability

- Retaliatory restrictions on Apple's Chinese operations

- Consumer boycotts in a market representing approximately 20% of Apple's revenue

Apple's expansion of manufacturing to India partially mitigates these risks, but not fast enough to provide meaningful insulation in 2026.

The Regulatory Coordination Problem

Jennifer Newstead's challenge isn't just defending against individual actions—it's managing the interconnected nature of these battles. Concessions made to satisfy EU regulators might be used as evidence by DOJ prosecutors. Indian court arguments about global versus local revenue could influence how other jurisdictions calculate penalties.

Apple needs a coordinated global strategy that satisfies different regulatory frameworks without creating precedents that undermine its position elsewhere. This is exponentially more complex than traditional legal defense.

The AI Imperative: Playing Catch-Up at Scale

Apple's AI position in early 2026 is uncomfortable. Competitors have established user habits with ChatGPT, Copilot, and Gemini integrated into daily workflows. Apple Intelligence, despite significant marketing, remains limited compared to competitors' offerings.

The Spring 2026 Siri Relaunch: Make or Break

The enhanced Siri scheduled for spring 2026 (likely with iOS 26.4) represents Apple's attempt to close the AI gap. Reports suggest integration with Google's Gemini framework, though Apple maintains that on-device processing remains primary for privacy.

This is Apple's calculated gamble: partnering with Google for cloud-based AI while maintaining privacy-focused, on-device processing for core functions. It acknowledges Apple can't match competitors in pure AI capability alone, but it can differentiate on privacy.

The risk is execution. If the spring Siri update is incremental rather than transformative, it confirms Apple has fallen decisively behind. Users have already developed habits with competing assistants—switching requires dramatic superiority, not feature parity.

The Monetization Question

Apple needs to demonstrate how AI drives revenue. Services growth has been Apple's margins story; AI monetization is critical for maintaining growth rates. The likely path: Apple Intelligence Pro subscriptions for advanced features.

But here's the regulatory complication: requiring subscriptions for AI features on a platform Apple controls invites antitrust scrutiny. Apple must prove it's offering value, not leveraging platform dominance.

The Privacy Paradox

Apple's privacy-first approach, while differentiating, creates technical constraints. Competitors can leverage massive cloud infrastructure and data collection to improve AI models continuously. Apple's on-device processing requirement means slower iteration and less personalization capability.

The partnership with Google for certain Siri functions is Apple acknowledging this limitation. But it creates strategic dependency on a competitor. If Google's relationship with Apple is disrupted by the DOJ's antitrust case against Google (which includes scrutiny of Apple's search deal), Apple loses critical AI infrastructure.

The Ecosystem Under Pressure

Apple's greatest strength—its tightly integrated ecosystem—faces challenges in 2026 that test its fundamental value proposition.

The Developer Relationship

App Store economics dominate developer frustration. As alternative app stores emerge in regulated markets and Apple's fee structures face challenge, the company must prove its platform delivers value beyond distribution. This means:

- Enhanced development tools and frameworks

- AI features that make iOS apps more capable

- Marketing and discovery advantages that justify fees

Developers watching Epic Games' alternative app store in the EU and alternative marketplaces in Japan are calculating whether Apple's ecosystem benefits justify its costs. If enough developers defect, network effects reverse.

The Hardware Lock-In Question

Apple's ecosystem relies on owning multiple Apple devices. But economic pressures (including memory costs driving device prices higher) may slow the multi-device adoption that creates lock-in. If consumers increasingly buy single devices rather than iPhone + iPad + Mac + Watch, ecosystem advantages diminish.

The Apple One subscription bundle attempts to create service-based lock-in independent of hardware quantity. But this requires proving services deliver unique value—which brings us back to AI capability.

What Success Looks Like in 2026

Apple's 2026 is defining because so many strategic vectors converge. Success requires:

Product Execution: Launching foldable iPhone, multiple Mac refreshes, Vision Air, and smart home products without major delays or quality issues despite supply chain pressures.

Leadership Transition: New executives in AI, design, legal, and operations delivering results equivalent to or better than their predecessors while coordinating strategy across a transition period.

Cost Management: Absorbing or passing through memory cost increases without sacrificing market share or margins significantly.

Regulatory Navigation: Satisfying diverse regulatory requirements across jurisdictions without undermining business model fundamentals or creating precedents that expose the company to escalating penalties.

AI Delivery: Launching Siri capabilities that genuinely close the gap with competitors while maintaining privacy differentiation and demonstrating clear monetization paths.

Ecosystem Defense: Maintaining developer and consumer loyalty to the Apple ecosystem despite platform openness pressures and increasing competition.

This is a demanding list. Apple has resources—$112 billion in net income, $162 billion in cash and marketable securities, and the world's most sophisticated supply chain. But resources don't guarantee execution during transitions.

What Failure Looks Like

The concerning scenario isn't catastrophic collapse—Apple is too large and well-positioned for that. It's a gradual erosion of advantages:

Product delays and quality issues undermine Apple's reliability reputation. New leadership struggles to coordinate, creating execution gaps. Memory costs force either margin compression (disappointing investors) or price increases (losing market share). Regulatory battles result in business model concessions that reduce services growth. AI capabilities remain behind competitors, causing users to rely more on third-party services. The ecosystem becomes less differentiated as regulatory requirements create platform openness.

The result isn't failure—it's Apple becoming a very profitable but more ordinary technology company, losing the premium valuation that reflects its unique market position.

The Verdict: High Stakes, Uncertain Outcome

Apple's 2026 is genuinely pivotal. The company has engineered an ambitious product roadmap, executed a planned leadership transition, and positioned itself to navigate regulatory challenges. But the convergence of these pressures with external market shocks (memory costs) and competitive AI advances creates genuine risk.

The optimistic case: Apple's scale, brand, and ecosystem advantages allow it to absorb cost increases competitors cannot, new leadership accelerates AI development, the foldable iPhone captures consumer imagination, and regulatory battles are managed without major business model disruption. Apple emerges from 2026 stronger, having successfully navigated a complex transition.

The pessimistic case: Leadership transitions create execution gaps, memory costs compress margins or force unpopular pricing, product launches face supply constraints or quality issues, AI capabilities remain behind competitors, and regulatory concessions undermine the business model. Apple remains highly profitable but loses the strategic advantages that justify its premium valuation.

The realistic case is probably somewhere between—Apple successfully navigates some challenges while struggling with others, emerging changed but still dominant. What makes 2026 defining is that the challenges are simultaneous and interconnected. Success in one area doesn't guarantee overall success; failure in any area cascades.

For those watching Apple closely, 2026 promises to be fascinating. The company is attempting to execute one of the most complex strategic transitions in its history while external forces beyond its control apply unprecedented pressure. Whether Apple emerges stronger or begins a gradual decline from its current heights depends on execution, timing, and factors beyond even Apple's legendary control.

The year ahead will test whether Apple's culture of operational excellence, strengthened by decades of success, can adapt to a new generation of leadership, products, and challenges. The outcome will shape the technology industry for years to come.

Discussion