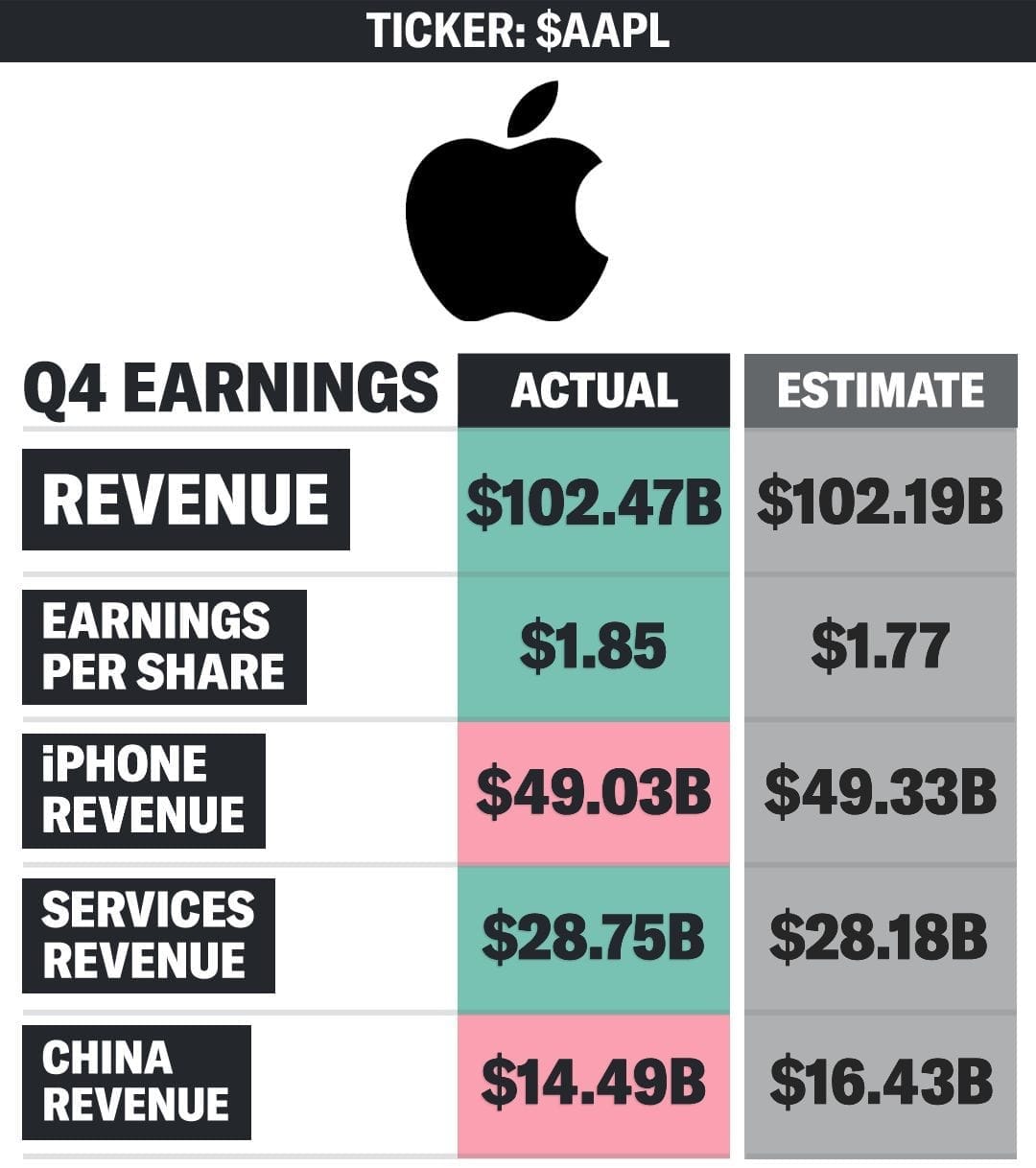

The Big Picture: Record-Breaking Numbers

Apple posted record Q4 revenue of $102.5 billion with net profit reaching $27.5 billion, translating to $1.85 per share—a substantial beat against Wall Street's expectations of $101.27 billion in revenue and $1.73 per share. To put this in perspective, last year's Q4 profit was just $14.7 billion, though that figure was significantly impacted by a one-time $10.2 billion EU tax charge.

The gross margin improved to 47.2 percent, up from 46.2 percent year-over-year, demonstrating Apple's continued ability to command premium pricing even in challenging economic conditions. For the full fiscal year 2025, Apple reached $416 billion in total revenue, marking a 6% increase over 2024 and setting all-time records across multiple product categories.

iPhone 17: The Star of the Show

The standout performer? The iPhone 17 lineup. CEO Tim Cook characterized demand as "off the chart," noting that store traffic is up significantly year-over-year and Apple set a September quarter record for upgraders. This enthusiasm isn't just marketing speak—Apple actually came out of Q4 with backorders as supply constraints limited how many units they could deliver.

What's driving this enthusiasm? Cook attributes it simply: "I think it's all about the product." The iPhone 17 lineup launched at the same $799 starting price as its predecessor despite widespread concerns about price increases, while the iPhone 17 Pro received substantial upgrades including a vapor cooling chamber and an enhanced camera system. The company also introduced the iPhone Air, its thinnest iPhone ever, which some speculate previews technology destined for a potential foldable device.

Notably, Apple was "a bit short" of iPhone 16 manufacturing capacity relative to demand in the previous quarter, but they've clearly corrected course for the iPhone 17 generation.

Services: The Quiet Profit Machine

While iPhones grab headlines, Apple's Services segment hit an all-time revenue record of $28.8 billion, up from $25 billion in the year-ago quarter. This represents 15% growth to $24.97 billion in sales, making it Apple's fastest-growing segment with higher profit margins than hardware.

The Services business encompasses iCloud, Apple Music, App Store fees, Google search licensing, payment fees, and AppleCare warranties. Cook noted that "most of the components in the Services business were seeing accelerating growth"—a promising indicator for recurring revenue streams that investors prize. CFO Kevan Parekh confirmed Apple expects similar Services growth to continue into the current quarter.

Mixed Results in Other Product Lines

The rest of Apple's hardware portfolio showed a more nuanced picture:

Mac: Mac revenue reached $8.7 billion, up from $7.7 billion last year, with the Mac install base hitting a new all-time high. However, Apple warned that next quarter's Mac sales face an "extremely difficult compare" since they launched several Macs late last year but only released the M5 MacBook Pro this year.

iPad: iPad sales were essentially flat at $6.95 billion, with Apple noting they didn't release a new model during the quarter. However, half of customers who purchased an iPad were new to the product, suggesting continued market expansion potential. An upgraded iPad Pro with an M5 chip launched in October, which should boost the following quarter's results.

Wearables: The Wearables category (including Apple Watch and Vision Pro) saw sales slip slightly to $9.01 billion from $9.04 billion year-over-year. Apple did launch the Apple Watch Series 11 and Apple Watch Ultra 3 with new features like hypertension monitoring and increased battery life.

The Tariff Reality Check

One of the more sobering discussions on the earnings call centered on tariffs. Apple absorbed $1.1 billion in additional tariff-related costs during Q4 and expects $1.4 billion in tariff costs for the December quarter. Critically, Cook confirmed that Apple has maintained its pricing strategy without passing tariff costs to consumers, instead absorbing them in gross margin.

This decision reflects Apple's confidence in its premium positioning and competitive advantage. Rather than risk dampening demand with price increases, they're banking on volume and maintaining market share—a calculated bet that seems to be paying off given the iPhone 17's reception.

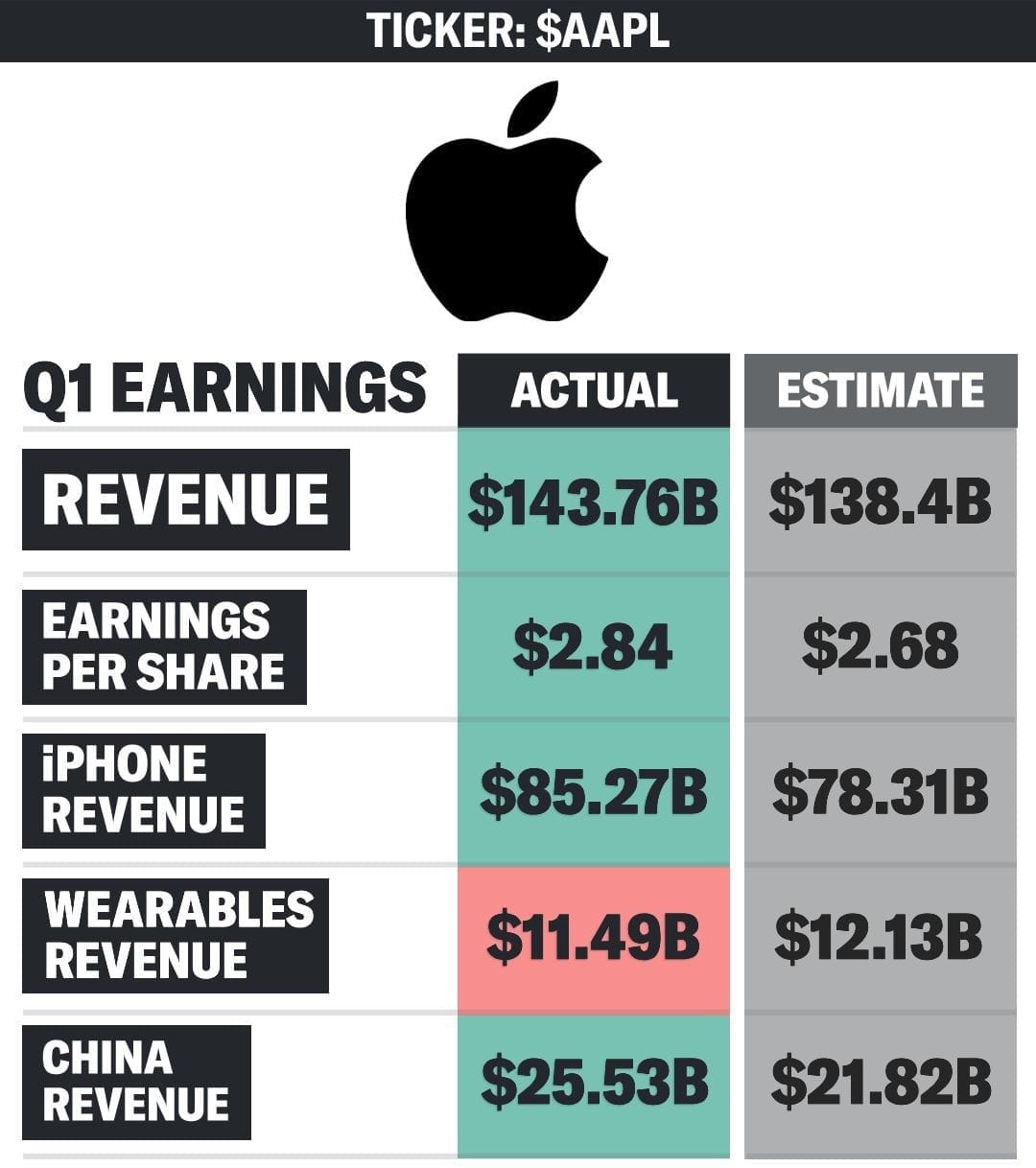

Looking Ahead: Best December Quarter Ever?

Perhaps the most bullish signal from the call was Apple's guidance for Q1 2026 (the December holiday quarter). Cook projected total company revenue growth of 10-12% year-over-year, with iPhone revenue expected to grow double digits. With this 11% growth forecast, revenue for the December quarter would reach approximately $137.97 billion—what Apple is calling its best December quarter ever.

This optimistic guidance surpasses analyst expectations of $132.31 billion in December quarter sales, suggesting Apple sees sustained momentum from strong iPhone 17 demand, growing Services revenue, and robust holiday shopping.

The AI Question Hanging Over Everything

What's notably absent from much of the earnings discussion? A clear AI monetization strategy. While Apple has made its on-device models available for developers and is seeing early adoption, questions remain about how AI features will translate to revenue beyond driving hardware upgrades.

When asked about AI's impact on the App Store, Cook noted there are "opportunities for developers and Apple to benefit" as on-device AI proliferates, but concrete details remain elusive. Analysts at Wedbush have suggested that proper AI monetization could add another $75 to $100 to Apple's share price in coming years—a significant upside that's not yet reflected in current valuations.

The Bottom Line

Apple's Q4 2025 results paint a picture of a company successfully navigating macroeconomic headwinds while capitalizing on strong product cycles. The iPhone 17's exceptional reception, combined with Services reaching new heights, provides a powerful one-two punch heading into the holiday season.

The company's willingness to absorb tariff costs rather than raise prices demonstrates confidence in their competitive position and long-term strategy. While challenges remain—particularly around Mac comparisons and the need to articulate a clearer AI monetization path—Apple's momentum suggests they're well-positioned to deliver on their ambitious December quarter guidance.

For investors and industry watchers, the key metrics to monitor will be whether iPhone 17 demand sustains through the holidays, how Services growth holds up, and when Apple provides more concrete details on how AI features will drive revenue beyond hardware sales. Based on these Q4 results, though, the company is entering that critical period from a position of considerable strength.

Apple's next earnings call in January will reveal whether this holiday quarter lives up to the "best ever" billing—and whether the iPhone 17 cycle has the legs to carry momentum into 2026.

Discussion