Apple has long been synonymous with innovation, crafting a reputation as the tech world's gold standard for design, security, and user experience. Yet, as we approach the midpoint of 2025, the company finds itself grappling with a series of setbacks in its pursuit of AI dominance through Apple Intelligence. From a high-profile security vulnerability to legal battles, user disillusionment, and global market pressures, Apple's AI journey is proving turbulent. With the fiscal Q3 earnings call scheduled for July 31, 2025, the stakes are high for Apple to address these challenges and restore confidence. Let’s unpack each dimension of this unfolding saga, exploring the technical, cultural, and geopolitical forces at play.

A Security Slip-Up with Far-Reaching Implications

The first major blow to Apple’s AI ambitions came in early 2025 with the discovery of a macOS vulnerability nicknamed "Sploitlight" by Microsoft Threat Intelligence. Tracked as CVE-2025-31199, this flaw exploited how Spotlight, Apple’s system-wide search tool, indexes plugin data, potentially allowing attackers to bypass Transparency, Consent, and Control (TCC) protections. These protections are critical to safeguarding sensitive user data, such as files in the Downloads folder or metadata cached by Apple Intelligence for on-device processing. The vulnerability, disclosed publicly by Microsoft on July 28, 2025, after Apple silently patched it in macOS Sequoia 15.4 in March, exposed a rare chink in Apple’s privacy armor.

For a company that has staked its brand on being the gold standard for user privacy, the irony of Microsoft—a longtime rival with its own history of security critiques—uncovering the issue was particularly stinging. As one analyst quipped on X, it’s akin to “Coke telling everyone Pepsi’s got a leaky bottle.” Beyond the embarrassment, Sploitlight raised serious questions about Apple’s ability to integrate complex AI systems without compromising its privacy-first ethos. Unlike traditional software, AI systems like Apple Intelligence require vast datasets and intricate processing pipelines, which can introduce new attack vectors. The vulnerability could have allowed malicious actors to access not just user files but also AI-generated insights, such as summarized emails or calendar predictions, which are deeply personal.

Apple’s response was swift but understated, with no public acknowledgment of the flaw’s severity. This reticence only fueled speculation on platforms like X, where users and security experts debated whether Apple’s rush to roll out Apple Intelligence contributed to the oversight. Posts on X suggested that internal pressures to compete with AI leaders like Google and OpenAI may have led to rushed testing, a departure from Apple’s historically meticulous approach. The incident has also sparked broader discussions about whether on-device AI, Apple’s preferred approach to preserve privacy, is inherently more vulnerable to local exploits compared to cloud-based systems favored by competitors.

Legal Headaches and the Cost of Overhype

The Sploitlight debacle was just the beginning of Apple’s troubles. In June 2025, a class-action lawsuit filed by shareholders accused Apple of misleading investors about the readiness of Apple Intelligence, particularly enhancements to Siri promised at WWDC 2024. The lawsuit names CEO Tim Cook, CFO Luca Maestri, and other top executives, alleging that Apple’s grandiose claims about AI-driven features—like a context-aware Siri capable of handling complex, multi-step tasks—were made without a working prototype. Shareholders argue that these promises inflated stock expectations, only for reality to crash down when Apple announced delays in key features.

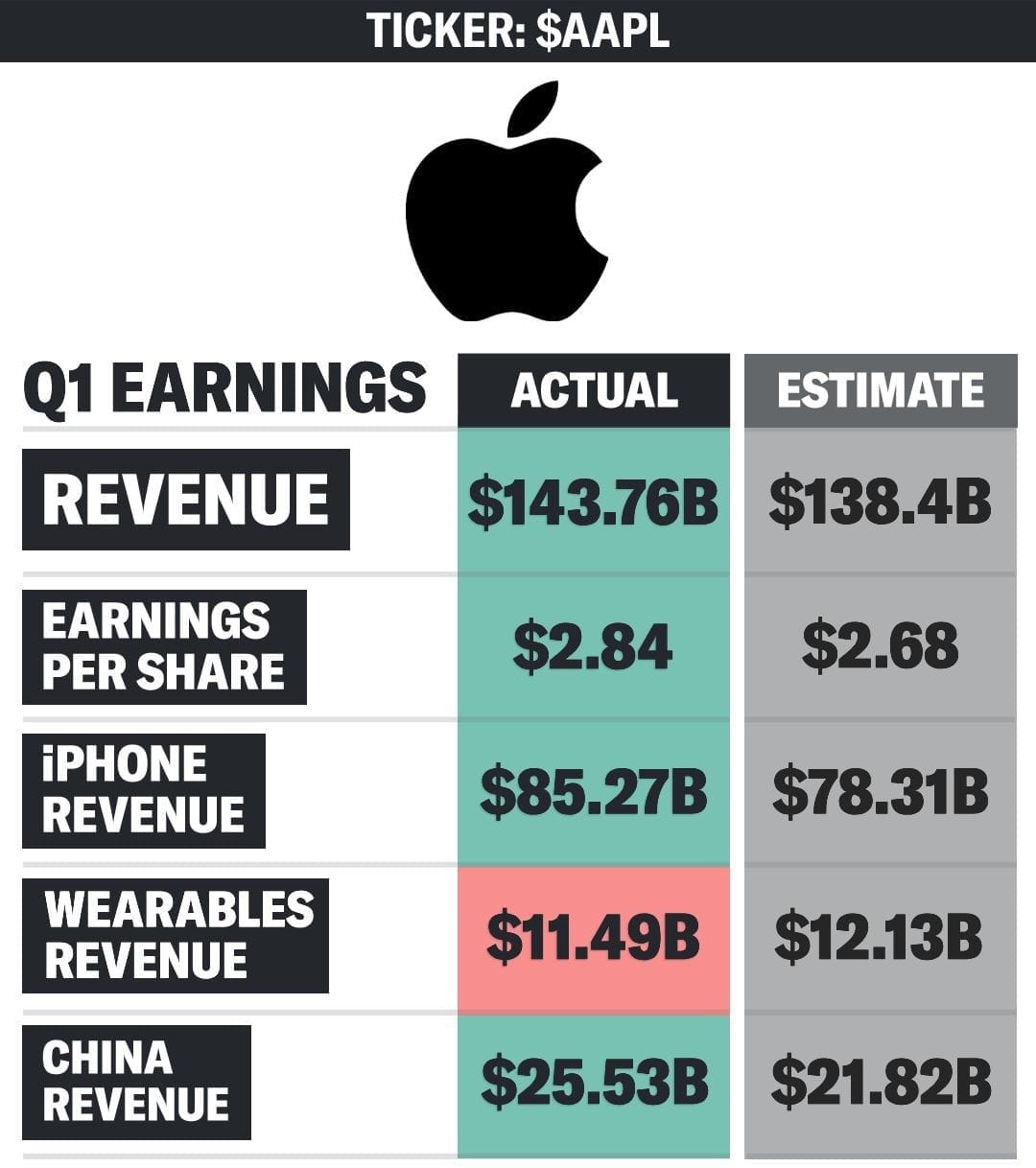

The financial impact has been significant. As of July 29, 2025, Apple’s stock price stood at $211.20, down 14% year-to-date, representing a loss of approximately $450 billion in market capitalization from its 2025 peak. While earlier reports exaggerated the drop at 25%, the current decline is still a stark reminder of investor skepticism. The lawsuit claims that Apple’s failure to deliver on WWDC promises—such as a Siri that could rival ChatGPT in conversational depth—eroded trust, with delays pushing major updates to iOS 26.4 in spring 2026. Analysts have called this a “classic case of promising the moon but delivering a flashlight,” a sentiment echoed across financial blogs and X discussions.

User Backlash: From Hype to Disappointment

Apple’s challenges extend beyond Wall Street to its loyal user base, which had high hopes for Apple Intelligence following WWDC 2024. The promise of a revamped Siri—one that could finally compete with Google Assistant, Alexa, or even newer players like Anthropic’s Claude—was a major selling point. Yet, the features delivered so far, such as Genmoji (AI-generated emoji mashups) and basic reminder enhancements, have been met with widespread disappointment. Social media platforms, particularly X, are awash with memes portraying Siri as the “slow kid in class,” struggling to keep up with its AI peers.

The gap between expectation and reality has driven a rare phenomenon: reports of longtime iPhone users switching to Android for access to more advanced AI tools. Posts on X highlight users praising Google’s Gemini for its contextual understanding or Samsung’s Galaxy AI for real-time translation features, areas where Siri lags. Analyst Ming-Chi Kuo, a respected Apple watcher, noted in a July 2025 report that Apple internally acknowledges Apple Intelligence’s “underwhelming” performance and its limited impact on driving iPhone 17 upgrades. Features like Visual Intelligence, which allows users to create calendar events from screenshots, are clever but niche, failing to deliver the transformative experience promised.

This user backlash is particularly damaging because Apple’s ecosystem thrives on loyalty. The company’s closed ecosystem—where iPhones, iPads, and Macs work seamlessly together—has historically kept users locked in. But as AI becomes a core part of the smartphone experience, Apple’s lag is prompting some to question the value of staying. On X, one user summed it up: “I’ve been Team Apple since the iPhone 4, but if Siri can’t even schedule my day properly, what’s the point?” This sentiment, while anecdotal, reflects a broader erosion of trust that could have long-term implications for Apple’s market share.

Technical and Philosophical Roadblocks

Apple’s AI struggles are not just about execution; they stem from deep technical and philosophical challenges. The company’s commitment to on-device AI processing, driven by its privacy-first philosophy, limits its ability to leverage the massive computational power of cloud-based systems used by competitors like Google, Microsoft, and OpenAI. On-device processing requires fitting complex models onto devices with constrained resources, a feat Apple has achieved with its Neural Engine but at the cost of scalability. For example, while Google’s Gemini can tap into vast cloud resources for real-time data analysis, Apple Intelligence relies heavily on local processing, which caps its ability to handle large-scale generative tasks.

Apple’s “ship-when-perfect” culture, long a strength in delivering polished hardware like the iPhone or MacBook, has become a liability in the fast-moving AI landscape. Competitors are releasing iterative AI features rapidly, even if imperfect, to capture market share and user feedback. Apple, by contrast, delays launches until features meet its exacting standards, leading to missed opportunities. As one X post put it, “If you’re not first, you’re forgotten,” a harsh reality in a market where generative AI tools are evolving weekly. This perfectionism has also stalled Apple’s ambitions in new categories, such as a rumored smart home hub powered by AI Siri, which remains in limbo due to software delays.

Internally, Apple’s AI development has faced hurdles. Reports from X suggest that Apple’s AI teams are stretched thin, with some engineers reassigned from other projects to bolster Apple Intelligence. The company’s acquisition of smaller AI startups has helped, but integrating these technologies into Apple’s walled garden has proven complex. Moreover, Apple’s reliance on partnerships—like its deal with OpenAI to integrate ChatGPT into iOS—has sparked debate among fans who see it as an admission of weakness. On X, one user asked, “Why is Apple outsourcing its AI soul to OpenAI? That’s not the Apple way.”

The Global Arena: China and Beyond

Apple’s AI challenges take on a global dimension, particularly in China, the world’s largest smartphone market. In Q2 2025, China’s smartphone sales fell 4%, but local brands like Honor, Huawei, and Vivo surged, capturing 70% of the market. Apple slipped to fifth place with a 15% share, down from 18% a year earlier, as Chinese consumers embraced AI-packed devices from domestic players. Honor’s Magic V3, for instance, boasts AI-driven features like real-time language translation and predictive text input, backed by government incentives for local AI development. Apple’s “cool foreign brand” allure, once a major draw, is fading as Chinese brands offer cutting-edge features at lower price points.

Geopolitical tensions exacerbate the situation. U.S.-China trade disputes have led to tariffs on Chinese-made goods, pushing Apple to diversify its supply chain to India and Vietnam. However, new tariffs on Indian-made products, introduced in early 2025, have disrupted this strategy, increasing production costs. Apple’s attempts to integrate Chinese AI models, such as Baidu’s Ernie, to comply with local regulations have also hit roadblocks due to U.S. export controls on advanced AI technologies. These political challenges highlight a stark reality: sometimes, the biggest tech hurdles aren’t technical but geopolitical.

Beyond China, Apple faces pressure in Europe, where regulators are scrutinizing its AI practices under the Digital Markets Act (DMA). Concerns about data privacy and ecosystem lock-in could force Apple to open up its AI APIs, potentially weakening its control over the user experience. These global dynamics underscore the complexity of Apple’s AI strategy, which must balance innovation, compliance, and brand identity across diverse markets.

Earnings on the Horizon: A Pivotal Moment

As Apple prepares for its July 31, 2025, earnings call, analysts expect modest revenue growth of 4% to $88.96 billion for Q3, with earnings per share around $1.42–$1.43. Services revenue, driven by subscriptions like Apple Music and iCloud, is expected to offset slowing iPhone sales, but the spotlight is firmly on Apple’s AI roadmap. Investors are eager for clarity on timelines for delayed features like the advanced AI Siri and whether Apple can address supply chain and tariff pressures.

The broader question looms: can Apple deliver top-tier AI while maintaining its privacy commitments? Competitors like Google and Microsoft have embraced cloud-based AI, trading some privacy for performance, while Apple insists on a hybrid model with heavy on-device processing. This approach, while admirable, may limit Apple’s ability to compete in areas like generative AI, where scale is critical. On X, analysts and users alike are debating whether Apple can find a middle ground or if it’s doomed to compromise either privacy or innovation.

Apple’s leadership faces a make-or-break moment. A strong earnings call, with concrete AI milestones and a clear vision, could restore confidence. But vague promises or further delays risk cementing the perception that Apple is falling behind. The company that once defined the smartphone era now faces skepticism about its ability to lead in the AI era. As one commentator on X put it, “Apple used to set the pace; now it’s chasing the pack.” The billion-dollar question remains: can Apple reconcile its privacy ethos with the demands of cutting-edge AI, or will trade-offs define its future?

Discussion