Apple’s first fiscal quarter of 2026 wasn’t just another “record holiday quarter.” It was the clearest signal yet that Apple is shifting from being a cyclical hardware story to a platform story built on three pillars: a massive installed base, a high-margin services engine, and a cautiously ambitious push into AI.

For Apple fans, this quarter explains why your devices keep getting more integrated and more “sticky.” For investors, it shows why Apple can still grow double digits at Apple’s scale while defending margins in a tougher component and regulatory environment.

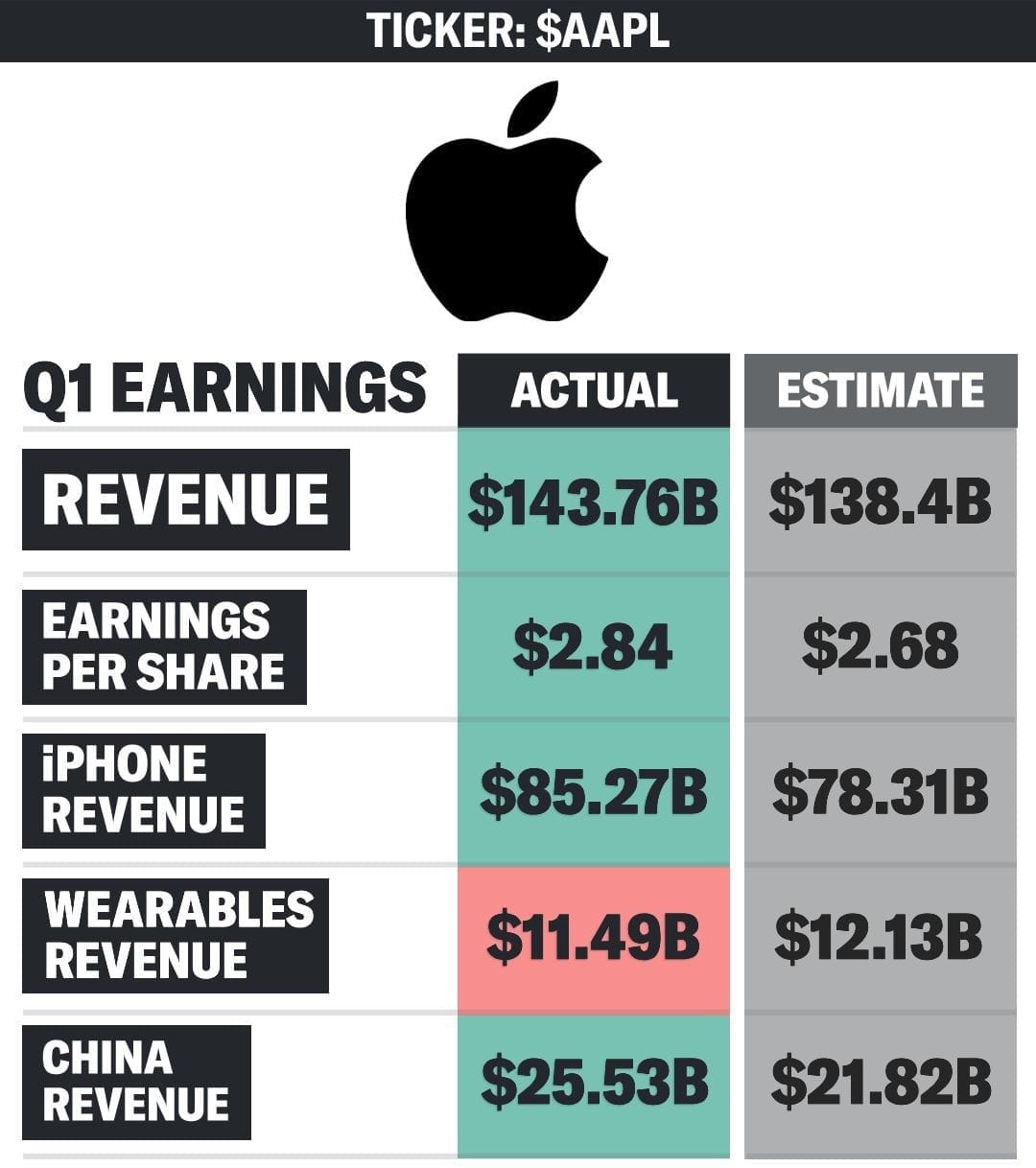

The Numbers: A Big Quarter, Even by Apple Standards

Apple reported revenue of about $143.8 billion, up roughly 16% year over year. Net income reached $42.1 billion, with earnings per share of $2.84, up about 19%. Gross margin came in at a striking 48.2%, helped by the mix of premium iPhones and the continued rise of services.

Looking ahead, Apple guided to revenue growth of around 13–16% next quarter, with gross margin expected to hold in a very healthy 48–49% range. In other words: management is signaling that this is not a one-and-done spike, but part of a sustainable phase of high-margin growth.

Under the headline numbers, a few themes stand out: an iPhone cycle that’s stronger than almost anyone expected, services approaching platform-like scale, and early AI features that are already showing usage traction.

iPhone 17 Cycle: “Simply Staggering” Demand

iPhone was the star of the quarter. Revenue from iPhone hit about $85.3 billion, up roughly 23% year over year. Tim Cook described demand as “simply staggering,” and Apple set all-time iPhone revenue records in every major geography.

Two things are happening at once here:

- A powerful upgrade cycle. After a few more muted years, the current iPhone lineup is converting a lot of holdouts. 3nm-class silicon, camera improvements, and better battery life are table stakes; what’s new is the pull from Apple Intelligence features—users upgrading not just for hardware, but for on-device AI and a more capable Siri.

- Supply, not demand, is the constraint. Apple is effectively in “supply chase mode.” Advanced 3nm manufacturing capacity is tight across the industry, and Apple is taking as much as it can get. The bigger constraint isn’t whether users want the latest iPhone; it’s how fast Apple and its partners can build them.

From an investor perspective, this matters because it changes the risk profile. Historically, the question each cycle was “Will Apple create enough demand?” Right now, it’s “Can Apple fulfill the demand it already has?” That’s a higher-quality problem to manage.

2.5 Billion Active Devices: The Platform Behind the Numbers

Quietly, the most important milestone of the quarter might be the one with no immediate revenue attached: Apple’s installed base has passed 2.5 billion active devices, up from about 2.35 billion a year ago.

That 150 million device increase in a year is the foundation for everything else Apple is doing:

- Every new app, subscription, and payment runs on this base. Whether it’s Apple Music, iCloud storage, Apple TV+, Apple Pay, or future offerings like Creator Studio and deeper Apple Intelligence services, they all monetize the same installed base.

- Switchers and first-time buyers stay crucial. Across Mac and iPad in particular, Apple stressed that a large share of buyers this quarter were new to the platform. These aren’t just one-off device sales; they are future subscribers.

- Lock-in is becoming value-add. The more Apple integrates AI across devices—sharing context between your iPhone, Mac, Watch, and AirPods—the harder it is to leave. But the trade-off is increasingly clear value to the user, not just ecosystem friction.

Services: A $30 Billion Quarter with Plenty of Runway

Services revenue reached an all-time high of about $30 billion, growing roughly 14% year over year. That’s nearly the size of a Fortune 100 company, inside Apple, running at software-like margins.

Within services, Apple highlighted strength across:

- App Store and advertising. Apple now sees around 850 million weekly App Store users, and has paid out over $550 billion to developers cumulatively. App Store and video both hit record levels for the December quarter, and Apple continues to refine how and where it shows ads (including new App Store ad placements).

- Video (Apple TV+). Viewership on Apple TV is up about 36% year over year, and Apple’s original content has racked up more than 650 wins and 3,200 nominations. That’s no longer an experimental content play; it’s a real driver of engagement and Services ARPU.

- Music and cloud services. Apple Music and iCloud storage continue to grow, quietly adding recurring revenue attached to nearly every device sale.

- Payments and Wallet. Apple Pay and digital IDs are steadily turning the iPhone into a primary identity and payments device in more markets, with each new geography adding incremental revenue and stickiness.

For investors, the story here is margin and durability. Services are growing faster than hardware and carry much higher margins. As long as the 2.5 billion device base keeps expanding and engaging, Services can compound without Apple needing a breakout new hardware category every few years.

Beyond iPhone: Mac, iPad, and Wearables

Mac: Soft Quarter, Strong Fundamentals

Mac revenue came in around $8.4 billion, down roughly 7% year over year. On the surface, that looks like a weak spot. But context matters: Apple is lapping a very strong prior-year compare, and the company noted that nearly half of Mac buyers were new to the platform, with customer satisfaction around 97%.

From an enterprise and education standpoint, that new-buyer mix is critical. It suggests that Apple Silicon Macs and the broader macOS ecosystem are still converting Windows users, even in a tougher PC market. Those new Macs, in turn, feed demand for iCloud, productivity apps, and potentially Apple Intelligence features as they scale beyond iPhone.

iPad: Quietly Growing with More First-Time Buyers

iPad revenue reached about $8.6 billion, up around 6% year over year. Apple emphasized that more than half of iPad buyers were new to iPad, and that the installed base is at an all-time high with record numbers of upgraders.

That’s not a blowout number, but it’s a healthy signal in a category that many had written off as mature. With newer Apple Pencil capabilities, improved displays, and the overlap with Apple Intelligence and creative workflows, iPad is increasingly a gateway into the broader Apple ecosystem.

Wearables, Home, and Accessories: Demand Outpacing Supply

Wearables, home, and accessories revenue was about $11.5 billion, down roughly 2% year over year. On paper, that looks like a weak spot. In reality, it’s mostly a supply story, not a demand problem.

The main culprit: AirPods Pro 3. Apple underestimated demand for the new generation and ran into supply constraints during the quarter. Despite those constraints, demand was strong enough that Apple indicated the category likely would have grown if it could have shipped enough units.

Why the demand spike? The latest AirPods Pro bring a meaningful step up: better noise cancellation and sound quality, improved battery life, heart-rate monitoring, better fit and water resistance, plus tighter integration with Apple Intelligence features like Live Translation. For many users, AirPods have quietly become as important as the iPhone itself—especially when you factor in Apple Watch health and fitness use cases.

From a strategic standpoint, wearables and accessories deepen Apple’s role in daily life—health tracking, ambient audio, notifications—while keeping hardware margins high and reinforcing the services layer (Fitness+, Music, Podcasts, etc.).

Rising Memory Prices: A Margin Test Apple Is Ready For

One of the more under-the-radar themes on the call was rising memory prices. RAM and SSD component costs are climbing across the industry. Tim Cook noted that the impact on Q1 margins was minimal, but expects a more material effect in Q2. Apple says it is exploring “a range of options” to respond, without specifying exactly what those are.

Here’s what that likely means in practice:

- Apple has pricing power. Historically, Apple’s storage upgrades have carried very high margins. That gives the company room to absorb some of the cost increases without immediately raising retail prices across the board.

- Mix and configuration strategy. Apple can tweak default storage tiers, promotional offers, and regional pricing to manage the impact. It can also nudge users toward configurations where it has better cost leverage.

- Margin guidance suggests confidence. Even with higher memory costs, Apple is guiding to a 48–49% gross margin next quarter. That’s a strong signal that, between services mix, pricing flexibility, and operational efficiencies, Apple believes it can keep overall profitability intact.

For investors, the key is that Apple is facing the same input cost pressures as its peers, but from a position of much stronger margin and ecosystem leverage.

Apple Intelligence and the Google Partnership: AI, the Apple Way

AI featured prominently in Apple’s commentary, but in a very Apple-specific way. Rather than hyping parameter counts or building a hyperscale cloud from scratch, Apple is leaning into a hybrid model it calls Apple Intelligence—a mix of on-device models and Private Cloud Compute, designed to keep as much as possible at the edge while sending more complex tasks to secure Apple-run servers.

Some key points from the quarter:

- Rollout and languages. Apple Intelligence is expanding across 15 languages, with features like Visual Intelligence (understanding what’s on your screen), text generation and rewriting, and Live Translation increasingly woven into the OS.

- Engagement is already meaningful. Apple described the majority of eligible iPhone users as already engaging with Apple Intelligence features. That’s impressive considering how early the rollout is and how quietly many of these features show up in daily workflows.

- Siri gets a brain upgrade. A major part of the AI story is a more personal, context-aware Siri, powered by Apple’s own foundation models and a partnership with Google. Google’s AI models will help support Apple’s stack in certain queries, but under Apple’s privacy and UX constraints.

For users, the impact is subtle but important: better suggestions, smarter summarization, more useful Siri, and new capabilities like live cross-language conversations, all working across iPhone, Mac, and iPad.

For investors, there are a few things to watch:

- Engagement and Services ARPU. If Apple Intelligence increases how often people use their devices and services, that should translate into higher subscription and transaction revenue over time.

- Capex discipline versus hyperscalers. Apple is investing heavily in AI infrastructure, but is not trying to match the hyperscalers on generic cloud compute. Its Private Cloud Compute footprint is more targeted, which should help keep capital intensity lower than some competitors while still delivering meaningful AI features.

- Privacy and regulation. Apple is betting that a privacy-first, on-device-heavy AI approach will differentiate it with both customers and regulators. How that plays out against EU and US regulatory pressures, especially around the App Store and default services, remains an open question.

Geography: China Rebounds, India Builds Momentum

Regionally, two stories are worth highlighting.

- Greater China. Revenue in Greater China grew about 38% year over year, driven by the best iPhone quarter Apple has ever had in the region. Traffic was strong, upgraders hit records, and Apple gained share. This is especially notable given competitive and macro concerns in China over the past few years.

- India. Apple hit records across iPhone, Mac, iPad, and services in India, with most buyers in each category new to the product. The install base grew at a strong double-digit rate. India isn’t just a growth market for devices; it’s a long-term ecosystem play where Apple can replicate, at a different price mix, the kind of platform it built in mature markets.

For a company already as large as Apple, these geographies are critical to sustaining growth as North America and Europe mature. The combination of local manufacturing, retail expansion, and tailored financing offers is starting to show up in the numbers.

The Investor Lens: What This Quarter Really Says

Stepping back, what does Apple’s Q1 2026 tell us if you’re thinking as an investor rather than just a product fan?

- iPhone demand looks durable, not fad-driven. The current cycle isn’t being carried by one gimmicky feature; it’s driven by meaningful silicon advances, camera and battery improvements, and early AI capabilities that are likely to improve over time.

- Services are now a core profit engine. At a $30 billion quarterly run rate and growing faster than hardware, services give Apple a margin buffer against component cost swings, tariffs, and FX. They also make the business less dependent on any single hardware cycle.

- Margins are holding despite headwinds. Memory prices are rising, regulatory pressure is real, and supply constraints exist in both iPhone silicon and AirPods Pro 3. Yet Apple is guiding to roughly 48–49% gross margins. That combination of scale, pricing power, and mix is rare.

- Balance sheet strength remains a quiet advantage. Apple returned nearly $32 billion to shareholders this quarter via buybacks and dividends, and still holds about $145 billion in cash against roughly $91 billion in debt—net cash of around $54 billion. That gives Apple room to keep investing in AI, silicon, and manufacturing while continuing capital returns.

Valuation is always the contentious part of the Apple conversation. After a quarter like this, expectations tend to reset higher. The key question isn’t whether Apple can deliver another “record holiday” next year, but whether the combination of installed base growth, services, and AI can support mid-teens revenue growth and high-40s margins over a multi-year period. This quarter supports the optimistic case, but execution on AI and regulatory risk management will be crucial.

Where Apple Goes Next

Apple’s Q1 2026 wasn’t just a financial milestone; it was a strategic marker. The company is entering a phase where:

- Hardware remains premium and supply-constrained at the high end. iPhone, AirPods, and Apple Watch continue to lead their categories, with advanced silicon and tight integration keeping competitors at arm’s length.

- Services scale on top of a 2.5 billion device base. From App Store and advertising to video, music, and payments, Apple’s recurring revenue streams are becoming as important as unit sales.

- AI is woven into the OS, not sold as a separate product. Apple Intelligence and the Google partnership are early indicators of how Apple plans to compete in the AI era: less about headline-grabbing model launches, more about quiet, ubiquitous features that keep users inside the ecosystem.

For Apple enthusiasts, that means your next few years of devices will likely feel incrementally smarter and more personalized rather than radically different. For investors, it means watching not just how many iPhones Apple sells, but how deeply those iPhones—and the 2.5 billion devices they sit within—are tied into services and AI-driven experiences.

If Apple executes on that vision, Q1 2026 may end up being remembered not just as a record quarter, but as the moment the market started valuing Apple less like a hardware vendor and more like the integrated platform company it has quietly become.

Discussion