Apple announced its fiscal third-quarter earnings for 2025, showcasing a robust performance that exceeded Wall Street expectations. With a revenue of $94 billion and a net profit of $23.4 billion, the company set new records for the June quarter, driven by strong iPhone sales, a booming Services segment, and strategic moves in the face of global trade challenges. The earnings call, led by CEO Tim Cook and CFO Kevan Parekh, provided a deep dive into Apple’s financials, product performance, and forward-looking strategies, particularly around AI and supply chain dynamics. Let’s unpack the key highlights from the announcement.

Financial Highlights: A Record-Breaking Quarter

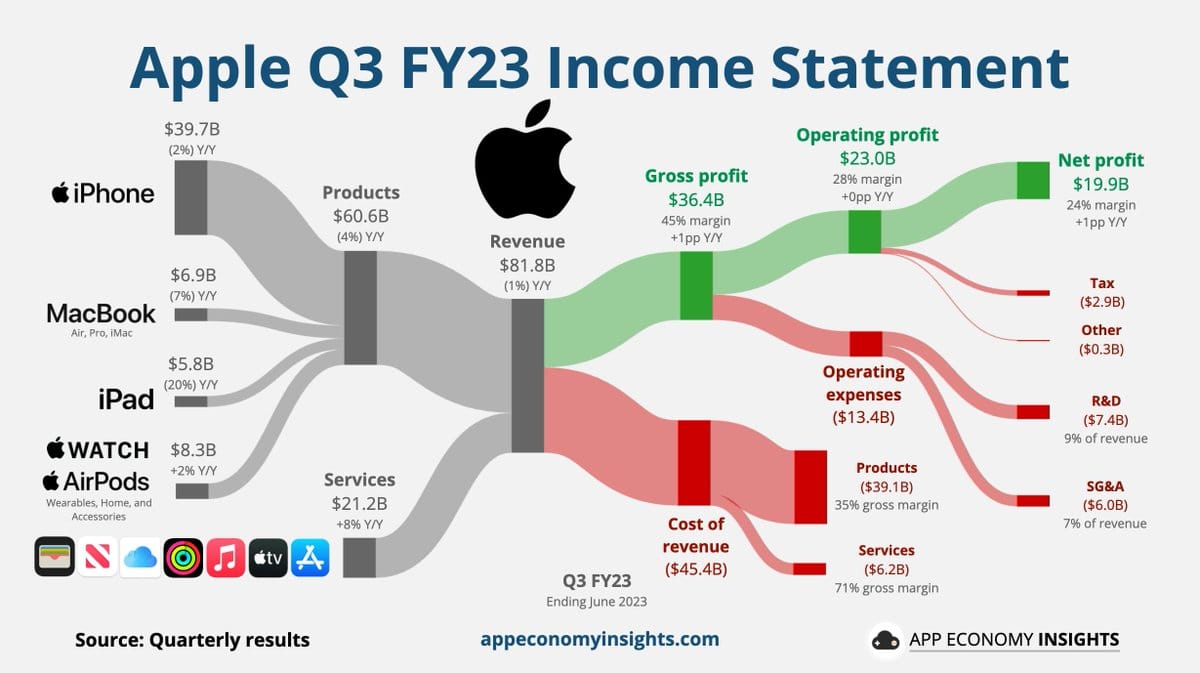

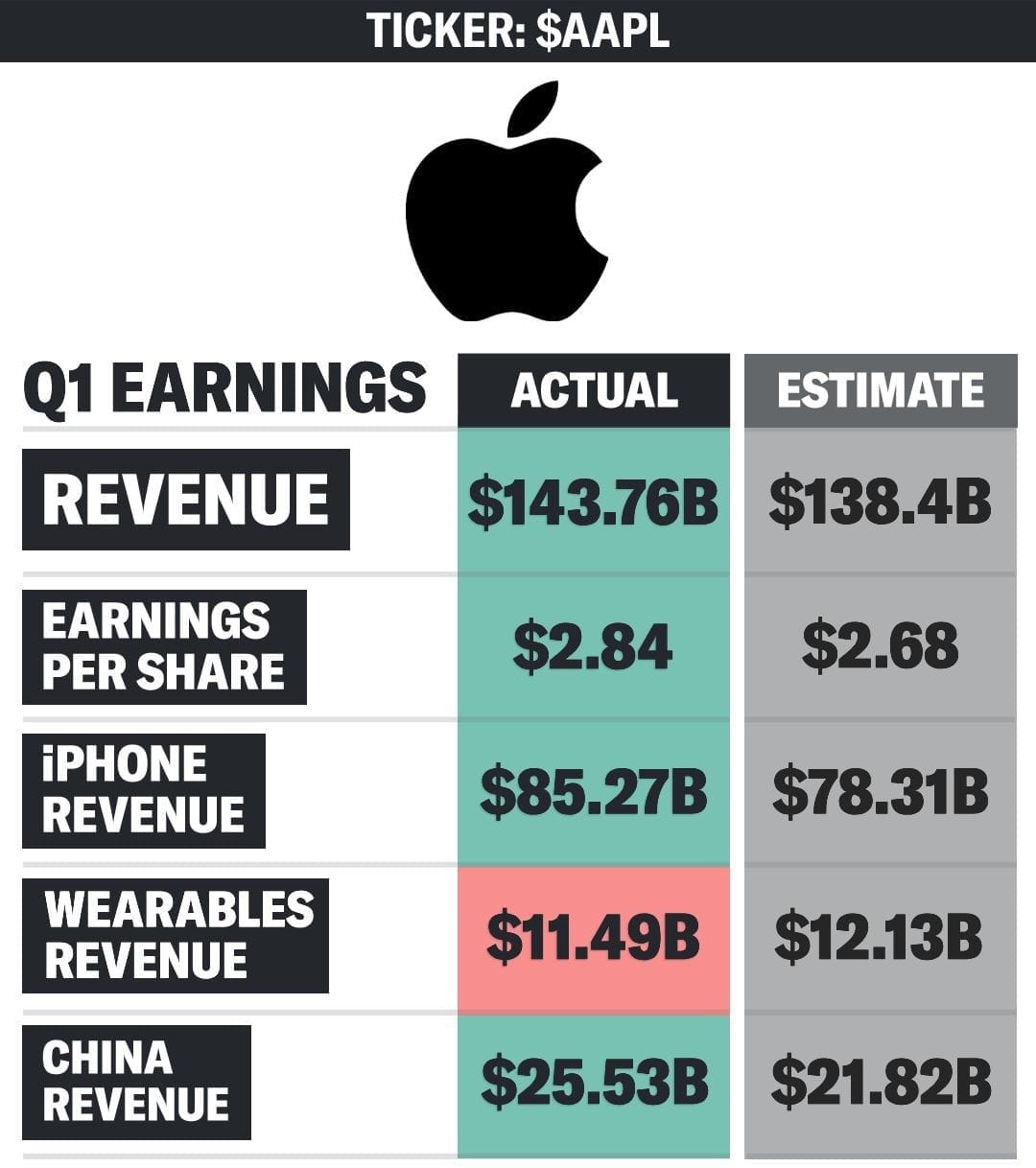

Apple’s Q3 2025 results were nothing short of impressive. The company reported a revenue of $94 billion, a 10% increase from the $85.8 billion recorded in the same quarter last year. Net profit rose to $23.4 billion, or $1.57 per diluted share, up from $21.4 billion and $1.40 per diluted share in the year-ago quarter. This growth translated to a 12% increase in earnings per share, a metric that thrilled investors and sent Apple’s stock up 2% in after-hours trading.

The company’s gross margin stood at 46.5%, slightly up from 46.3% last year, despite $800 million in tariff-related costs. Apple’s Services segment, which includes Apple Music, iCloud, and Apple TV+, hit an all-time revenue record at $27.4 billion, up 13% year over year. Product-wise, iPhone revenue soared to $44.6 billion (up 13%), and Mac revenue climbed to $8 billion (up 15%). However, iPad and Wearables, Home, and Accessories saw declines of 8.1% and 8.6%, respectively, due to tough comparisons from prior product launches.

Apple also declared a quarterly dividend of $0.26 per share, payable on August 14, 2025, to shareholders of record as of August 11. The company’s cash position remained strong, ending the quarter with $133 billion in cash and marketable securities, offset by $102 billion in total debt, resulting in a net cash position of $31 billion.

iPhone Momentum and the 3 Billion Milestone

The iPhone continues to be Apple’s crown jewel, with the iPhone 16 family driving a 13% revenue increase and setting a June quarter record for upgraders. Tim Cook attributed this success to the “strength of the product,” noting that the iPhone 16 outperformed its predecessor, the iPhone 15, by “strong double digits.” A significant milestone was also celebrated: Apple shipped its 3 billionth iPhone since the device’s debut in 2007, underscoring its enduring dominance in the smartphone market.

Customer satisfaction remains sky-high, with a 98% satisfaction rate in the U.S., as reported by 451 Research. The iPhone’s active installed base also reached an all-time high, reflecting strong loyalty and demand across all geographic segments.

AI: The Next Frontier for Apple

Artificial Intelligence (AI) was a central theme of the earnings call, with Tim Cook calling it “one of the most profound technologies of our lifetime.” Apple is doubling down on its AI investments, particularly in developing a more personalized Siri powered by Apple Intelligence. While these features, initially unveiled at WWDC 2024, were delayed and are now slated for a 2026 release, Cook expressed confidence in the progress, stating, “We’re making good progress on a more personalized Siri.”

The upcoming Siri enhancements will include better personal context understanding, on-screen awareness, and deeper app integration. For instance, users will be able to ask Siri about specific details, like a family member’s flight status, by pulling data from apps like Mail and Messages. However, the delay has sparked some backlash, with Apple facing multiple class-action lawsuits over the postponed features.

Apple is also exploring acquisitions to accelerate its AI roadmap. Cook noted that the company has acquired seven companies this year and is open to more if they align with Apple’s goals. He emphasized a hybrid AI strategy, leveraging both on-device processing with Apple Silicon and cloud-based capabilities through a private cloud compute architecture to maintain user privacy.

When asked about the potential commoditization of large language models (LLMs), Cook was cagey, saying it would “give away some things in our strategy.” This suggests Apple is carefully guarding its AI playbook while betting big on its integration across devices.

Navigating Tariffs and Supply Chain Challenges

A notable factor in Apple’s Q3 performance was the impact of tariffs, particularly following U.S. President Donald Trump’s April 2025 announcement of new import duties. Cook revealed that about one percentage point of Apple’s 10% sales growth was driven by consumers rushing to purchase devices, particularly iPhones and Macs, to beat anticipated price hikes. Reports had suggested iPhone prices could climb as high as $2,300 due to tariffs, prompting a “pull-ahead” in demand, especially in April.

Tariffs cost Apple $800 million in Q3, with an estimated $1.1 billion impact in the September quarter if current rates remain unchanged. To mitigate these costs, Apple is optimizing its supply chain and increasing U.S.-based manufacturing. Cook highlighted a $500 billion investment in the U.S. over the next four years, including chip production in Arizona and manufacturing facilities across 12 states. Additionally, the majority of iPhones sold in the U.S. are now assembled in India, while Macs, iPads, and Apple Watches primarily originate from Vietnam.

Services: A Growing Powerhouse

Apple’s Services segment continues to be a major growth driver, generating $27.4 billion in revenue, up 13% from $24.2 billion last year. Apple TV+ saw strong double-digit viewership growth and earned 81 Emmy nominations, reinforcing its position as a leader in original content. The App Store also posted double-digit revenue growth, with Cook calling it “the very best place to discover the latest apps” in a safe and trusted environment. Cloud services, driven by iCloud’s growing paid accounts, also hit an all-time revenue high.

Apple now boasts over one billion paid subscriptions across its services, a testament to its ability to monetize its massive installed base of active devices, which also reached a new all-time high across all product categories and regions.

Product Updates and Future Outlook

Beyond the iPhone, other product categories had mixed results. Mac sales were buoyed by the M4 MacBook Air, which helped set a June quarter record for upgraders. The iPad, however, faced an 8% revenue decline due to a tough comparison with last year’s iPad Air and Pro launches. The Wearables, Home, and Accessories category, including Apple Watch and AirPods, saw a 9% drop, though Apple Watch hit a new high for first-time buyers.

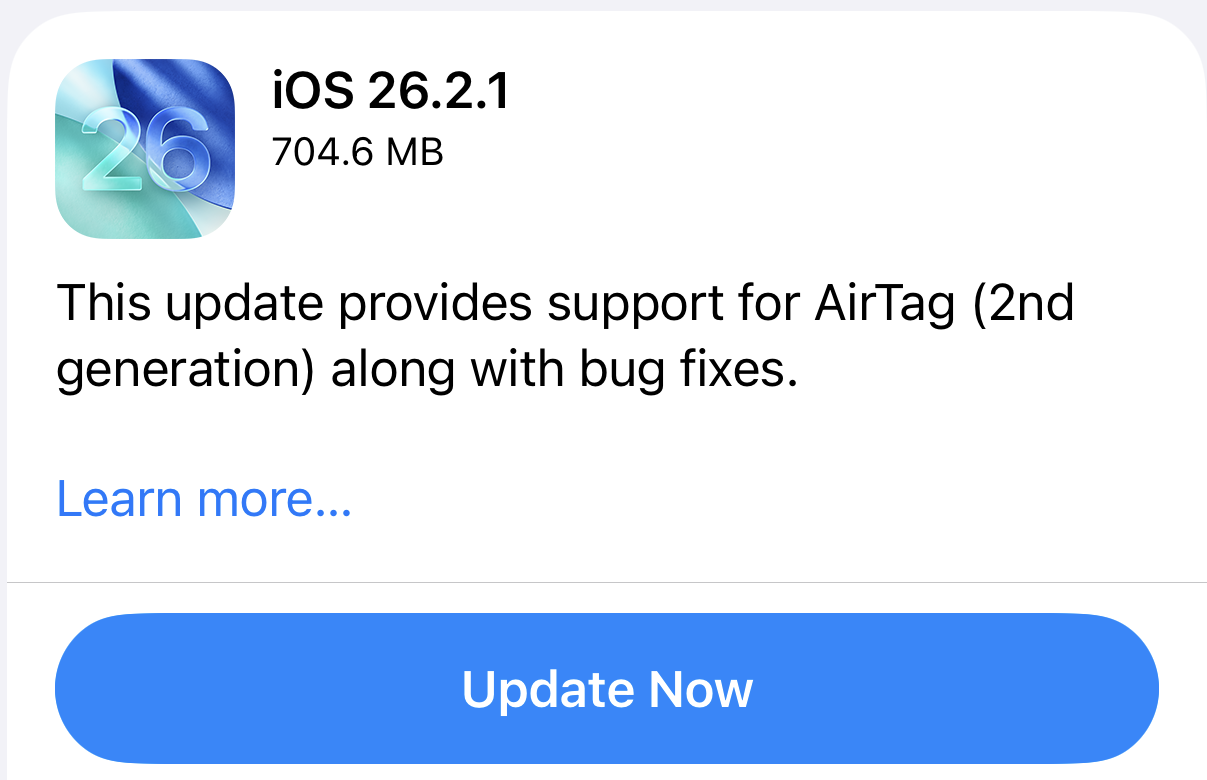

Looking ahead, Apple is gearing up for major software updates with iOS 26, macOS 26, iPadOS 26, and visionOS 26, which Cook described as the “most popular developer betas” in Apple’s history. Features like Live Translation, Workout Buddy, and a redesigned UI with Liquid Glass are set to roll out this fall. The company is also preparing to launch a new Apple TV model later this year, replacing the current Apple TV 4K.

Apple’s outlook for the September quarter is optimistic, projecting mid-to-high single-digit revenue growth and a gross margin between 46% and 47%. However, the company remains cautious about tariffs and macroeconomic uncertainties, with no formal guidance issued, continuing a trend of over five years.

Community Reactions and Market Sentiment

The MacRumors community had varied reactions to the earnings report. Some users, like BuddyTronic and AAPLbuyback, celebrated Apple’s strong performance, with comments like “The dogs keep barking but the train rolls on!” Others, such as TracesOfArsenic, were skeptical about Apple’s AI progress, calling Siri’s delays a “disaster.” Critics like WWP99 pointed out that tariffs are effectively a consumer tax, potentially impacting future pricing.

On the innovation front, debates raged. User 123123123 praised Apple’s M-series processors as “revolutionary,” while BuddyTronic argued there’s “zero innovation” at Apple, calling for a leadership change. Despite these mixed sentiments, Apple’s stock performance and financial metrics suggest the company remains a juggernaut, even as it navigates challenges like tariffs and AI development.

Final Thoughts

Apple’s Q3 2025 earnings underscore its ability to thrive in a complex global landscape. The iPhone’s enduring popularity, a booming Services segment, and strategic AI investments position Apple for continued growth. However, challenges like tariffs and delayed AI features highlight the delicate balance Apple must strike between innovation and operational efficiency. As the company prepares for its next wave of products and software updates, all eyes will be on how it delivers on its AI promises and navigates an increasingly volatile trade environment.

Discussion