YouTube just announced something the streaming TV industry has been avoiding for years: customers don't want to pay $83 per month for channels they never watch. Starting this week, YouTube TV is rolling out unbundled plans that let subscribers choose between Sports, News, Entertainment, and Family content packages, with pricing ranging from $44.99 to $71.99 per month.

The announcement, posted today by Josh Yang, Director of Product Management at YouTube, frames this as giving "customers more control over their subscriptions." That's technically accurate, but it's also an admission that YouTube TV's pricing had become untenable for anyone who didn't need comprehensive live television coverage.

The Unbundling That Should Have Happened Years Ago

YouTube TV launched in 2017 at $35 per month. By 2024, that price had ballooned to $82.99. The company blamed rising content costs, particularly sports rights fees that now dominate the economics of live TV streaming. But those increasing costs created a fundamental problem: non-sports viewers were subsidizing sports programming they never watched, while sports fans were paying for entertainment networks they ignored.

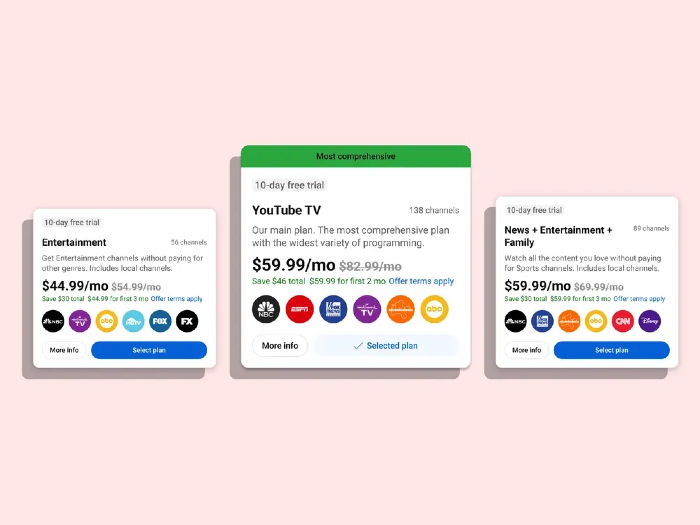

The new plan structure acknowledges this mismatch:

Sports Plan ($64.99/month, or $54.99 for new subscribers): This is the headline offering, cutting $18 from the main plan while keeping all major sports networks including FS1, NBC Sports Network, all ESPN networks, and the forthcoming ESPN Unlimited service. The pricing tells you everything about where YouTube TV's costs actually live.

Entertainment Plan ($54.99/month, or $44.99 for new subscribers): Without sports networks, the price drops $28 from the main plan. That's a 34% discount, which neatly quantifies how much sports programming inflates everyone's bill.

Sports + News Plan ($71.99/month, or $56.99 for new subscribers): For $11 less than the main plan, you get sports coverage plus news networks like CNBC, Fox News, MSNBC, and CNN.

News + Entertainment + Family Plan ($69.99/month, or $59.99 for new subscribers): Everything except sports for $13 less than the comprehensive package.

The main YouTube TV plan remains available at $82.99 per month for subscribers who want everything, positioning it as the premium option rather than the default choice.

What This Says About Streaming TV Economics

The aggressive new subscriber discounts, ranging from $10 to $20 off regular pricing, suggest YouTube TV is more concerned about subscriber growth than immediate profitability. These promotional rates mirror the cable TV playbook where carriers offered steep introductory pricing to lock in customers before eventual rate increases.

But there's a more interesting signal buried in this pricing structure: YouTube TV is essentially unbundling regional sports networks (RSNs) without saying so explicitly. The Sports Plan includes "all the major broadcasters" but doesn't specify which RSNs are included. Given the financial implosion of Diamond Sports Group and ongoing carriage disputes across the industry, it's likely these plans either exclude expensive RSNs or include them selectively.

The timing also matters. YouTube TV is launching these plans just as traditional cable continues losing subscribers and as competing services like Hulu + Live TV face similar pricing pressure. By offering sports-specific pricing, YouTube TV can compete more directly with dedicated sports streaming services while potentially recapturing cord-cutters who left because they couldn't justify paying $83 monthly for channels they didn't watch.

The Product Stays Intact

One notable aspect of this announcement: all the plans include YouTube TV's core product features. Unlimited DVR, six-member accounts, multiview, and key plays are available regardless of which channel package you choose. Add-ons like NFL Sunday Ticket, HBO Max, and 4K Plus can still be purchased on top of any base plan.

This suggests YouTube TV views its interface and features as competitive advantages worth maintaining across all pricing tiers. The company isn't creating budget plans with degraded experiences; they're simply acknowledging that not everyone needs every content category.

Why This Matters Beyond YouTube TV

YouTube TV's unbundling represents a broader acknowledgment that the streaming TV model copied too much from cable without fixing cable's fundamental problems. The traditional bundle worked when there were limited entertainment options and no way to watch sports without subscribing to expensive packages. That era is over.

What's less clear is whether this pricing structure will remain stable or if these new plans represent another waypoint on a journey toward even more granular options. The announcement mentions "10+ plans" rolling out over the next several weeks, suggesting YouTube TV may continue fragmenting its offerings based on subscriber feedback and adoption patterns.

The aggressive promotional pricing also raises questions about long-term sustainability. New subscribers get substantial discounts that presumably expire after some initial period. When those promotions end, will customers accept price increases to the regular rates, or will YouTube TV face a churn problem similar to what cable companies experienced with expiring introductory offers?

The Uncomfortable Reality

YouTube TV's new plans tacitly admit what the industry has been avoiding: sports programming is expensive, most subscribers don't watch it, and forcing everyone into a comprehensive bundle was benefiting content providers more than viewers. By separating sports from entertainment, YouTube TV is quantifying the real cost of live sports to streaming TV economics.

For customers, this is unequivocally good news. Options matter, and the ability to pay $45 monthly for entertainment networks instead of $83 for a bundle that includes sports channels you never watch is a meaningful improvement. But it also highlights how much margin existed in YouTube TV's previous pricing structure and raises questions about how long the industry can sustain current sports rights fees when they're no longer hidden in universal bundles.

The broader streaming market will be watching closely. If YouTube TV's unbundling succeeds, expect competitors to follow. If it fails, we'll likely see a return to the comprehensive bundle model with continued annual price increases. Either way, today's announcement represents a significant shift in how streaming TV services think about pricing and content packaging.

Discussion